Simpify Invoicing! Save Time! Get Paid!

THE BEST WAY TO CREATE INVOICES

The simplest way to invoice: use an invoice maker on mobile or laptop with customizable invoice templates. Save time and stay organized using an efficient invoice generator—ideal for freelancers, contractors, and small business owners.

features anchor

Our Invoice Maker features

Faster Payments

Benefit from integrated payment options for quick and secure transactions.

Effortless Navigation

Simple, intuitive platform to manage invoices easily and efficiently.

Mobile Flexibility

You can access and manage invoices on any device, anytime, anywhere.

Personalized Branding

Create custom-branded invoices to represent your business professionally.

Accurate Tax Management

Automated tax calculations that comply with local and global laws.

Insightful Analytics

You gain actionable insights into payments, overdue invoices, and cash flow trends.

Data Security

Enjoy peace of mind with encrypted storage of sensitive financial data.

Global Transactions

You can invoice in multiple currencies for international business operations.

Offline Access

You can create and edit invoices offline, syncing automatically when reconnected.

Timely Reminders

Receive automated alerts to keep your clients on track with payments.

Recurring Billing

You save time with automated invoicing for repeat transactions.

Multi-Language Support

You can invoice clients in their preferred language for better communication.

The Easiest Invoicing Software

You’ll Ever Use

Experience seamless invoicing with professional tools that work wherever you are. Easily create and send invoices or estimates on the go and switch from estimates to invoices with just one click.

Professional

Invoice Templates

Instantly create and send invoices with our online invoice generator or customizable, printable templates. Start professional invoicing in minutes with ready-to-use tools.

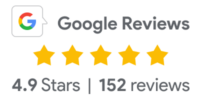

What Our Happy Users Say

Kelly Anderson

one year with us

Invoxa is a game-changer! The seamless interface and robust features keep my invoicing process stress-free.

Isla McAllister

two years with us

Invoxa takes the headache out of invoicing. It’s the perfect tool for scaling businesses!

Noah Johnson

two years with us

Invoxa’s customization tools let me keep my brand front and center. Highly recommend for pros!

Arjun Patel

three years with us

Multi-currency support makes international billing a breeze. Invoxa delivers real value!