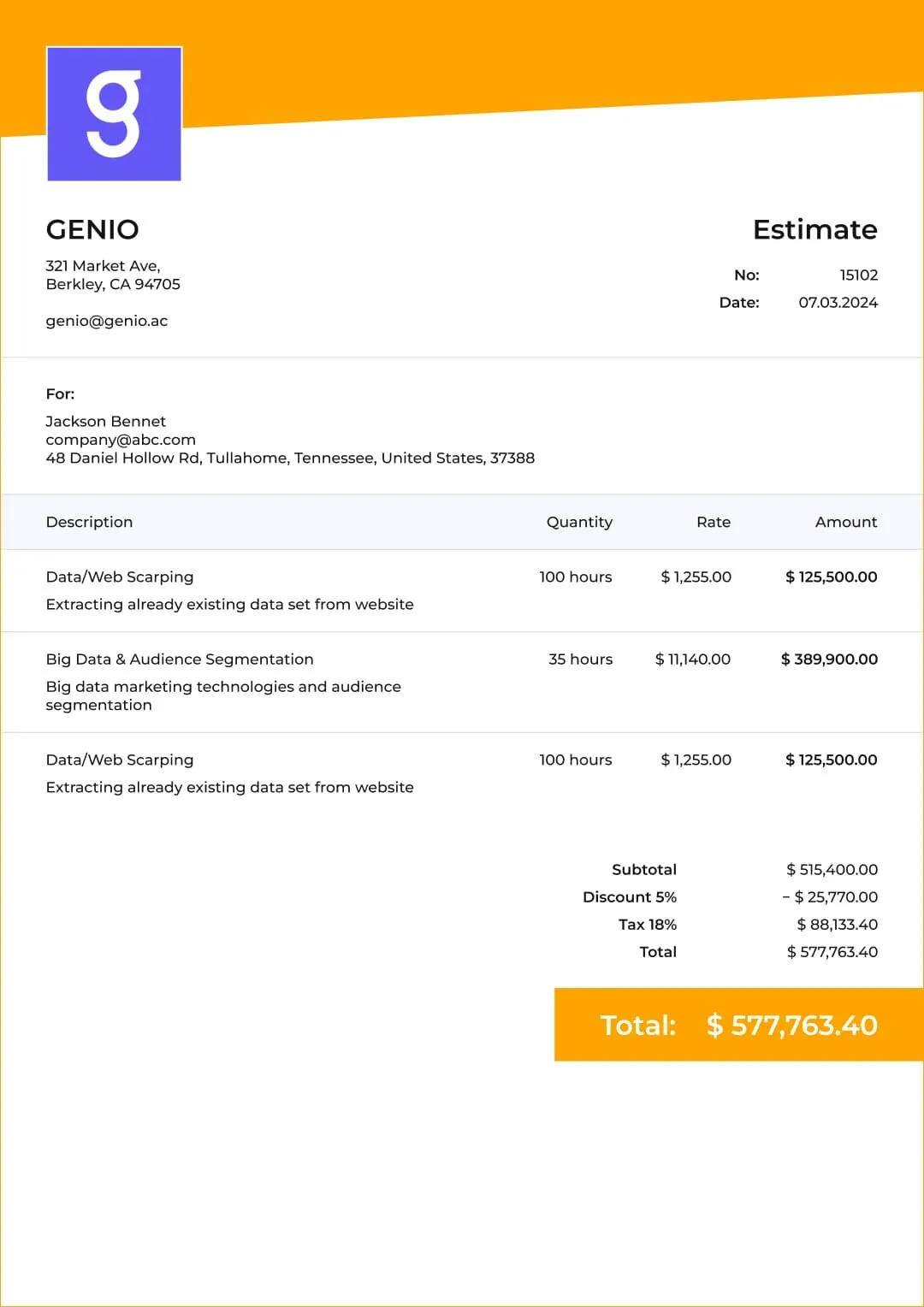

1099 Contractor Invoice Template

Step into a realm of financial efficiency and professionalism with the 1099 Contractor Invoice Template. It is a perfect tool designed to simplify the invoicing process for independent contractors and businesses alike. With the click of a button, you can download this PDF template and unlock a world of possibilities. With its sleek design and user-friendly interface, the 1099 Contractor Invoice Template transforms a mundane task into a streamlined experience. Say goodbye to the hassle of manually creating invoices and embrace the convenience of this template. From invoicing clients to tracking your earnings, this template has got you covered. The 1099 Contractor Invoice Template is more than just an invoicing tool; it is a gateway to financial clarity and organization. With its comprehensive features, you can effortlessly customize invoices to suit your brand and style. The template provides a structured format where you can input all the necessary details, ensuring accuracy and professionalism. Gone are the days of confusion and disarray when it comes to invoicing. The 1099 Contractor Invoice Template serves as your reliable companion, keeping your financial records in order. With this template, you can easily track your income, monitor outstanding payments, and maintain a clear record of your business transactions. Whether you are a seasoned contractor or just starting out, the 1099 Contractor Invoice Template is an indispensable tool for your financial success. It empowers you to take control of your invoicing process and focus on what truly matters – growing your business. Unleash the power of the 1099 Contractor Invoice Template and witness the transformation of your invoicing experience. Embrace efficiency, professionalism, and financial organization with this exceptional tool. Download the 1099 Contractor Invoice Template today and embark on a journey towards financial abundance. Your success story starts here.